Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

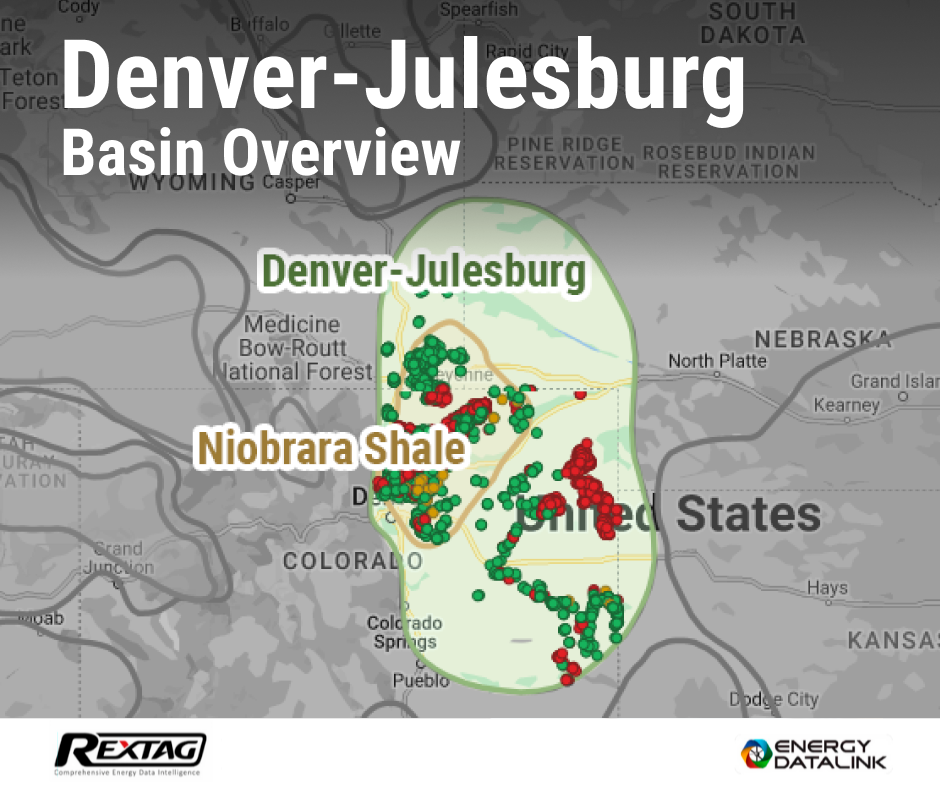

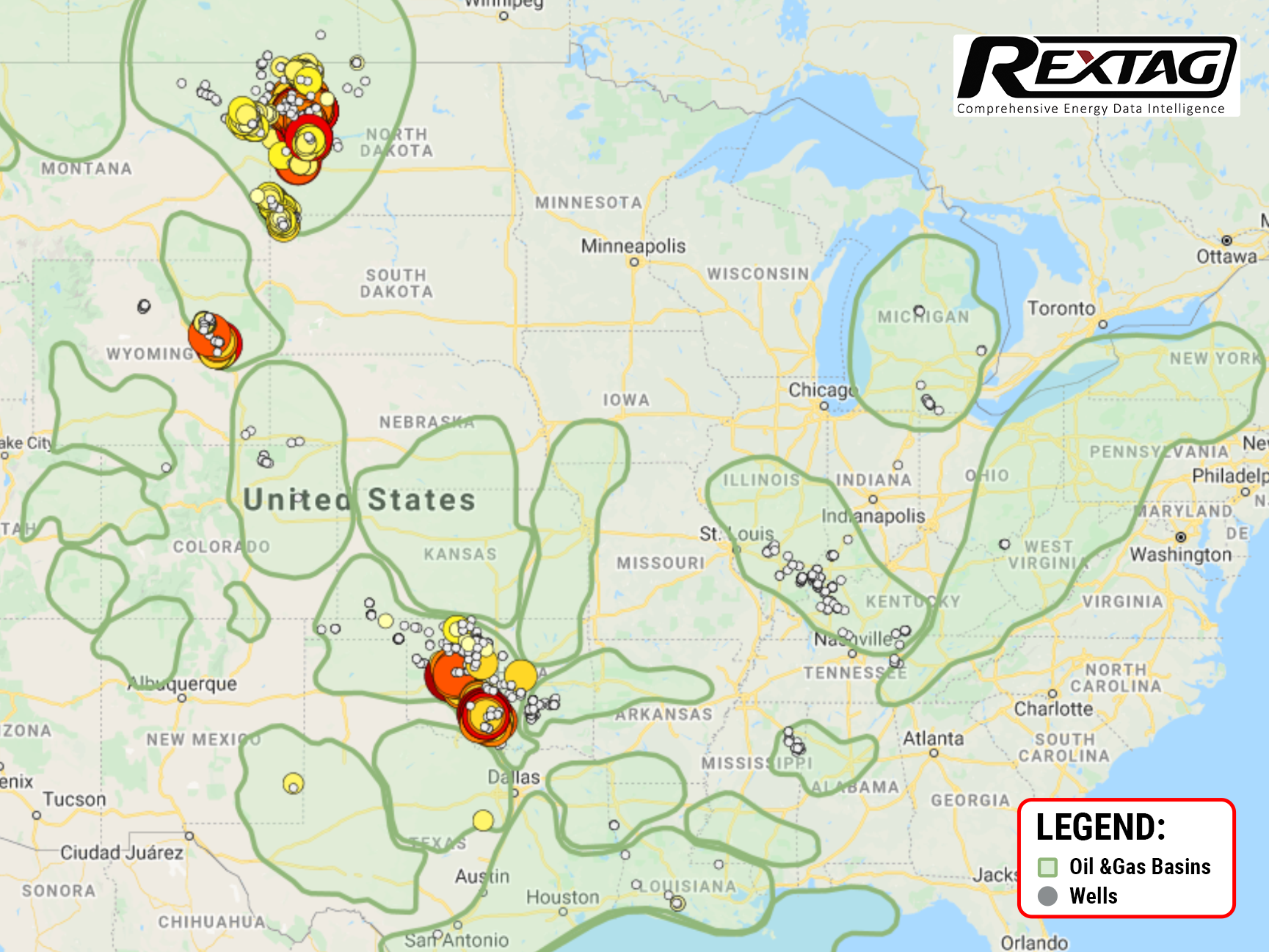

The Denver-Julesburg Basin Overview

Geologically, the Denver-Julesburg (DJ) Basin is a large structural basin with a complex history of sedimentary deposition, tectonic activity, and hydrocarbon generation. The basin covers approximately 20,000 square miles and extends into parts of Colorado, Wyoming, Nebraska, and Kansas. It is primarily composed of several stacked formations, including the Niobrara, Codell, and Greenhorn formations, which contain significant amounts of oil and gas reserves.

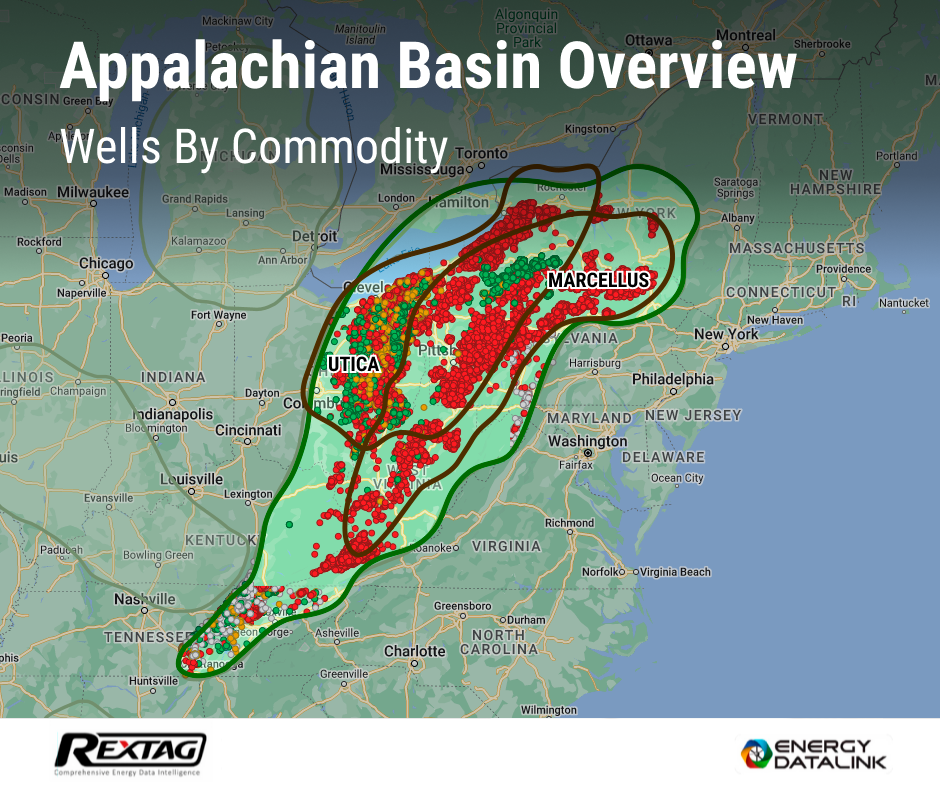

Appalachian O&G Basin 2022 Review

The Appalachian oil and gas basin is a geological formation that spans several states in the eastern United States, including Pennsylvania, West Virginia, Ohio, and New York. It is one of the largest natural gas reserves in the world, with estimates of recoverable natural gas exceeding 141 trillion cubic feet. The Marcellus Shale formation was formed over 350 million years ago and is composed of sedimentary rocks. Initially, the Marcellus Shale was not considered a significant source of natural gas due to the low permeability of the rock, which made it difficult for gas to flow through it and be extracted. However, with the development of hydraulic fracturing and horizontal drilling technologies in the early 2000s, it became economically viable to extract natural gas from the Marcellus Shale, and it has since become a major source of natural gas production in the United States.

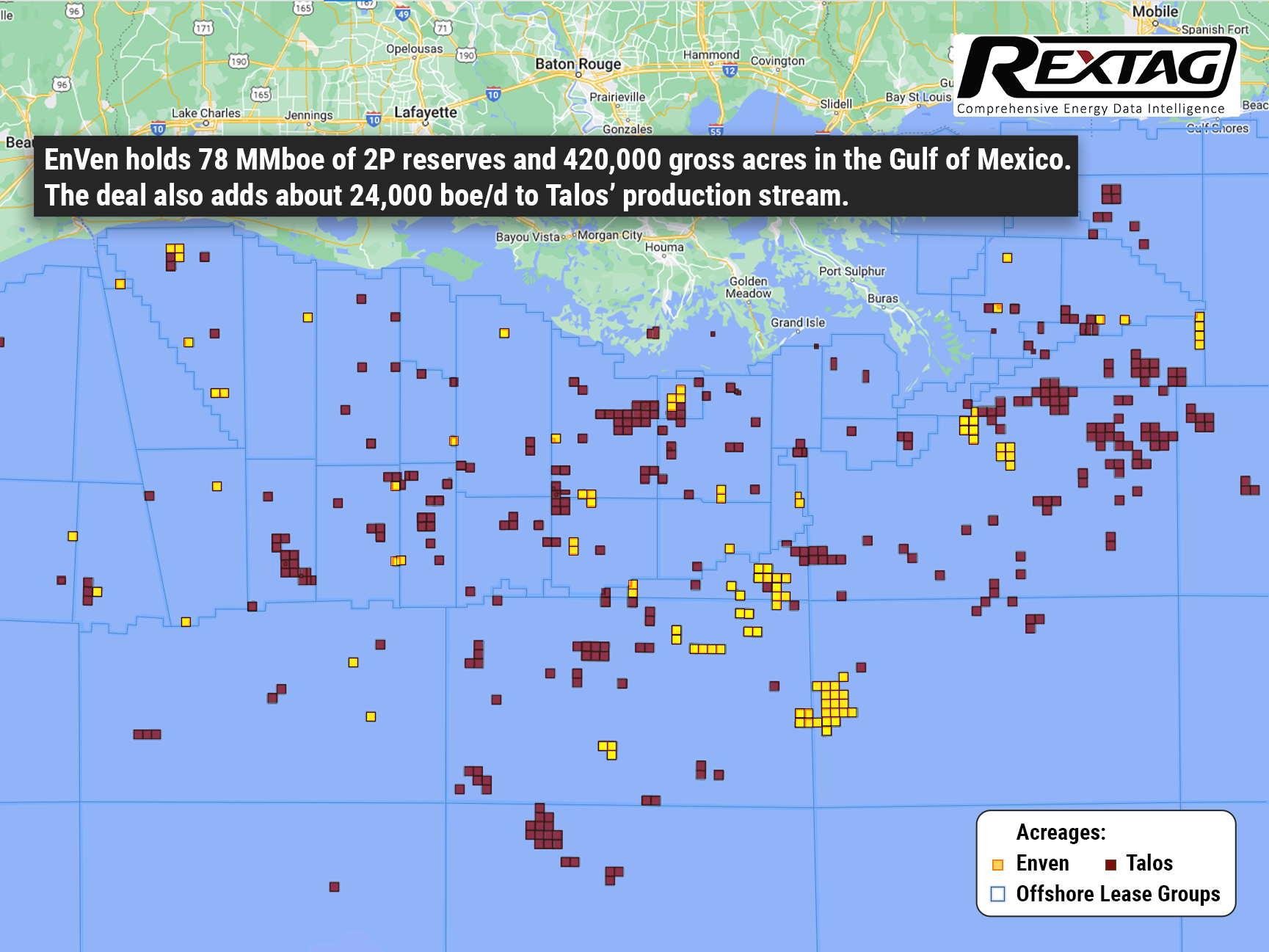

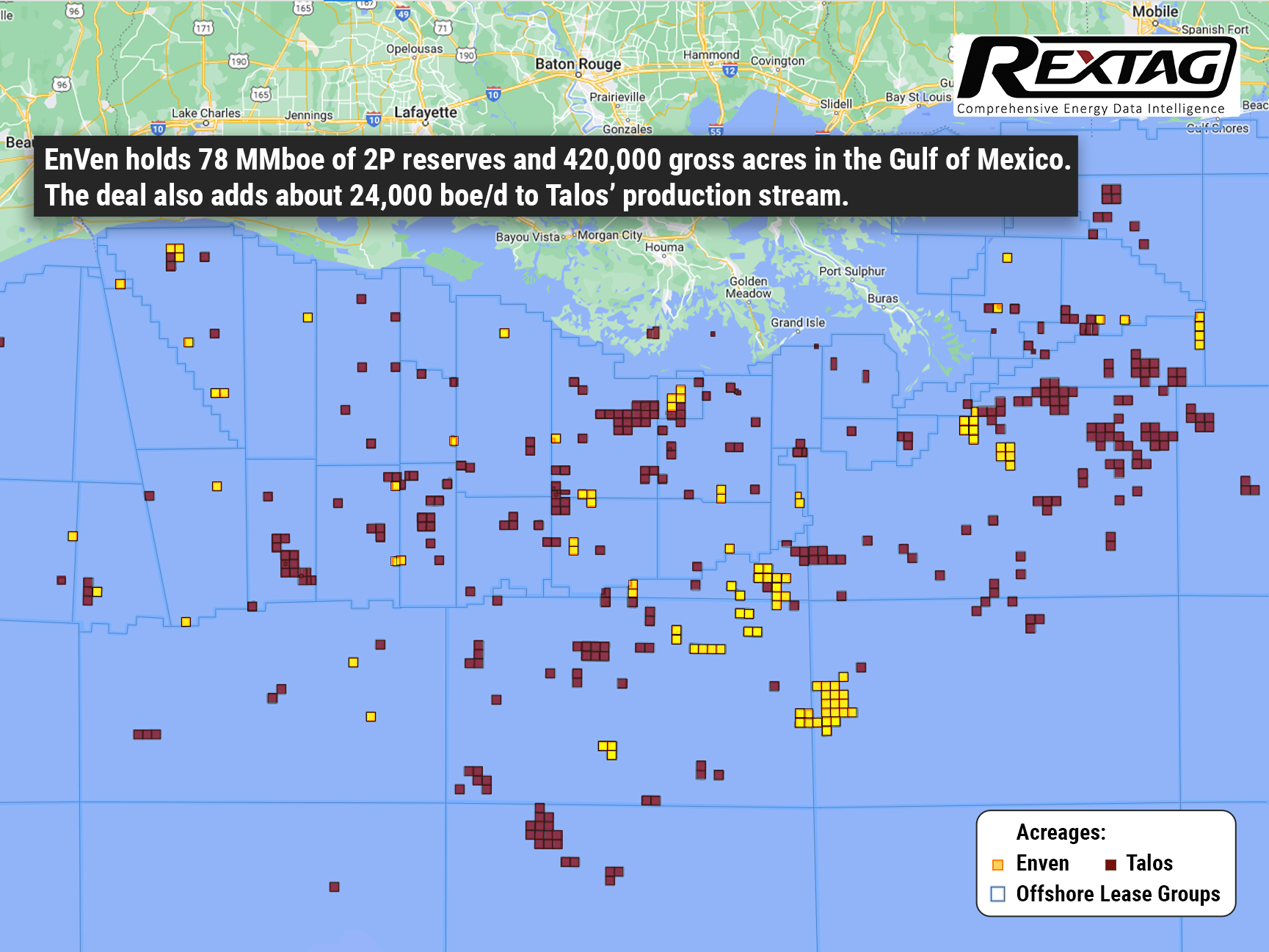

Talos Energy Plans to Close the EnVen Acquisition Soon: Stockholders to vote on $1.1B Deal on February 8

Talos Energy Inc. is closing its $1.1 billion purchase of private operator EnVen Energy. A special meeting for Talos’ stockholders to vote on the deal and other matters is set on February 8, according to a prospectus filed on January 11 with the Securities and Exchange Commission. Shareholders are being asked to approve the EnVen merger, which as the company considered in September would raise its Gulf of Mexico production up to 40%. According to a January 11 press release, Talos asserted that it anticipates closing the transaction soon after the meeting. Talos Energy Inc. supposes that adding EnVen would double its operated deepwater facility footprint, extending key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with the company operating more than 75% of the acreage it holds interests in. Talos is one of the largest independent operators in the U.S. Gulf of Mexico, with production operations, prospects, leases, and seismic databases spanning the basin in both Deep Water and Shallow Water. The company aims to actively grow through a balanced focus on asset optimization, development, and exploration while also seeking to add to its portfolio through acquisitions and business development.

Talos Energy Buys EnVen for $1.1 Billion to Expand

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%. The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint. EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream. Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

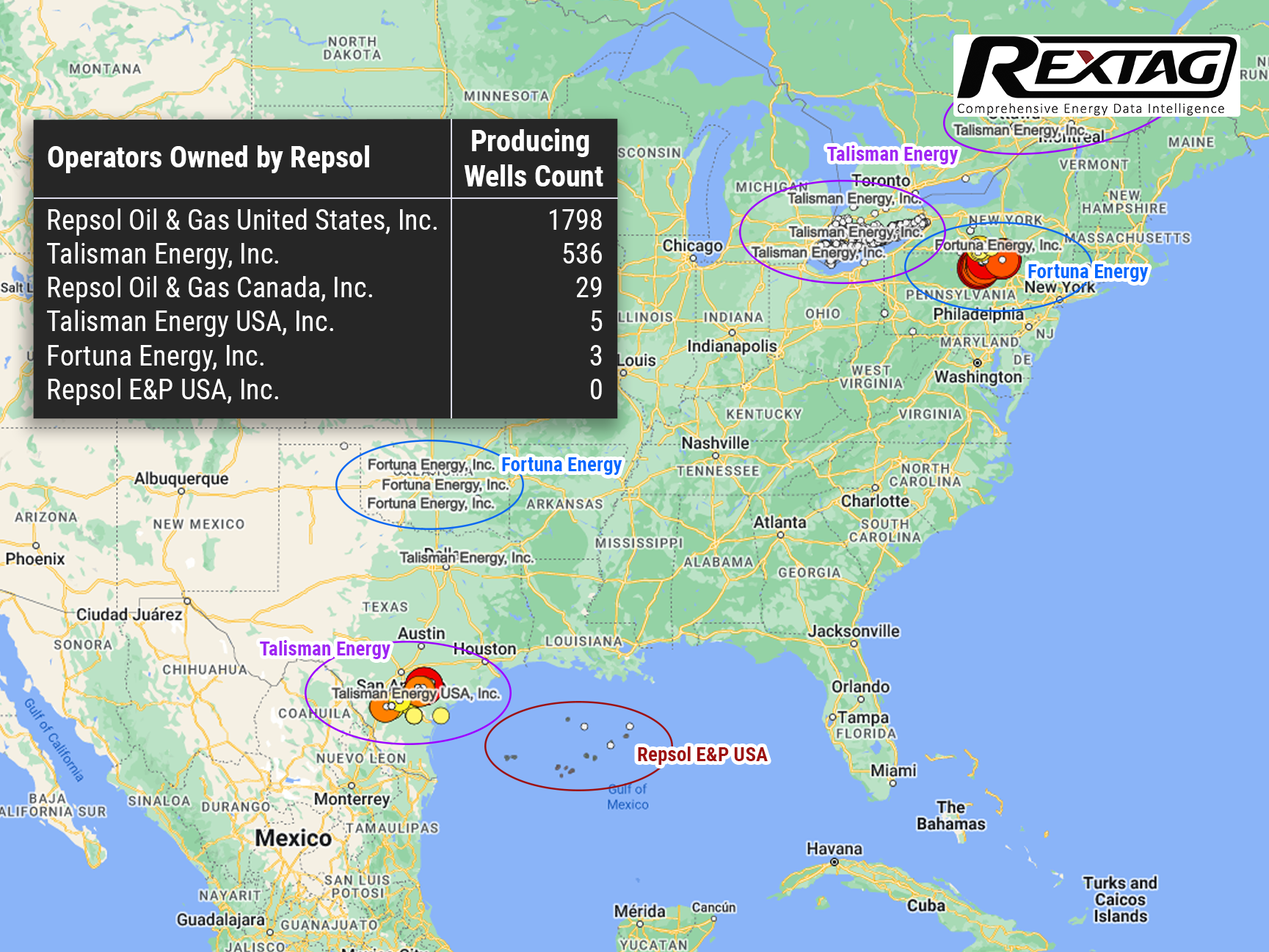

EIG Buys 25% of Repsol’s Oil and Gas Unit for $4.8 Billion

Spanish energy group Repsol is putting a 25% stake in its oil and gas exploration division on the market. U.S. fund EIG purchases it for $4.8 billion and builds up a war chest for renewables projects due to the transition of the energy industry to a lower-carbon future. As Reuters reported earlier this year, the deal values the whole business at $19 billion including debt, and may conduct a U.S. stock market listing of a stake in the unit after 2026, according to Repsol’s statement. The process commenced with an unsolicited offer from EIG, Reuters said in June, increasing Repsol's shares to a 14-year high. Moreover, shares grew up after an announcement on September 7 before declining 1.8% by 7:46 GMT. Nevertheless, they outperformed the European oil and gas index, which was down 2.3%.

Earthstone Expands Due to Acquisition of Titus’ Delaware

Earthstone Energy Inc., based in Texas, announced the transaction on June 28: the acquisition of Titus Oil&Gas which will raise production in the Delaware Basin by 26%. The $627 million acquisition fills the Permian Basin in Eddy and Lea counties, N.M. with 86 net locations on 7,900 net acres of leasehold, while it is not clear how much of the leasehold might be on federal acreage It is Earthstone’s seventh acquisition since 2021, a span that includes the closing of approximately $1.89 billion in acquisitions in the Permian Basin. The purchase of Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies backed by NGP Energy Capital Management LLC, is estimated at $575 million in cash and it is the equivalent of $52 million in stock (3.9 million shares of its Class A common stock based on the June 24 closing price). Titus shared that its net production in June was 31,800 boe/d. The company had reserves of approximately 28.9 MMboe. Earthstone is sure its net production will increase, at the midpoint, by 20,500 boe/d (65% oil) in the fourth quarter.

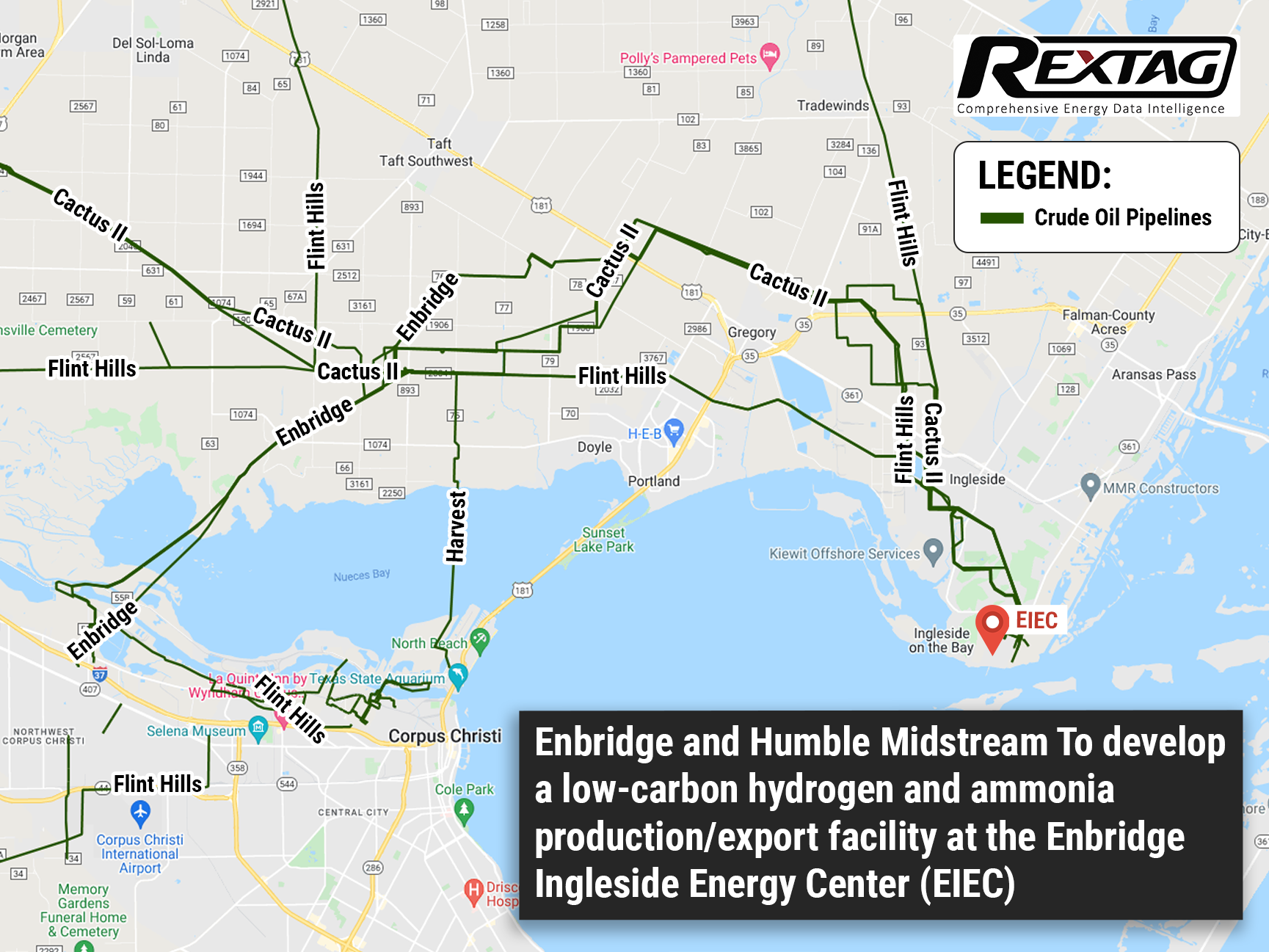

Crude Pipelines Infrastructure Developing at Enbridge Ingleside Energy Center

The joint project to improve and market a low-carbon hydrogen and ammonia production and export facility was presented on May, 6 by Enbridge Inc. and Humble Midstream LLC. Deployment of the facility is taken under the Enbridge Ingleside Energy Center (EIEC) basis close by Corpus Christi. Being the premier export facility on the U.S. Gulf Coast, the EIEC plays a vital role in world energy security and sustainability. Companies plan to develop a utility-scale efficiently low carbon production facility, able to combine both low-carbon hydrogen and ammonia to meet the growing global and domestic demand. It is expected to sequester up to 95% of CO2 generated in the production process in carbon capture facilities, especially ones owned and operated by Enbridge which makes this process a fully integrated low-carbon solution.

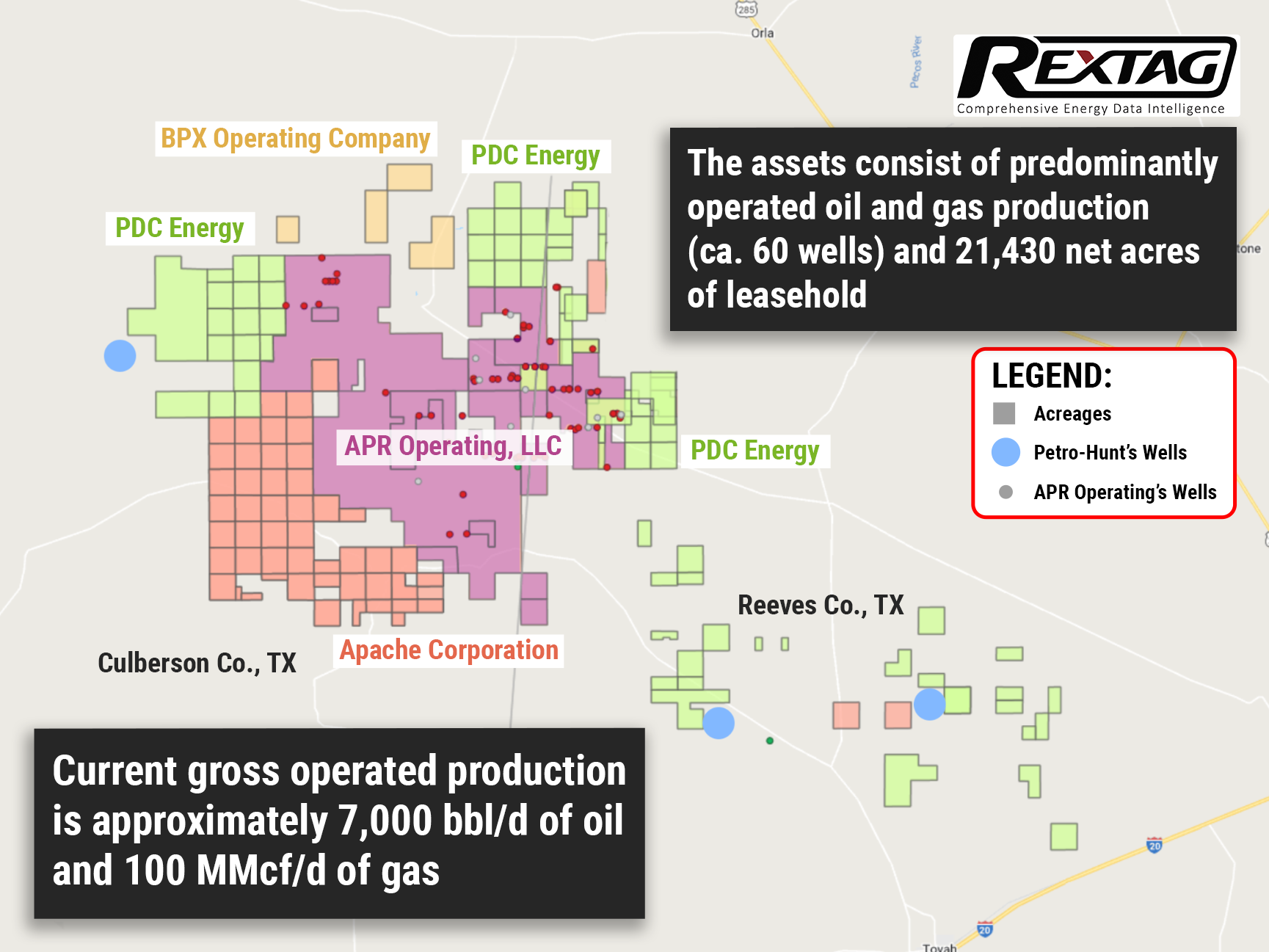

Winds of Change: Admiral Sold Its Assets in Delaware Basin

And Petro-Hunt E&P is the new sheriff in town with 21,430 net acres of leasehold in the Basin, production of which surpasses 7,000 bbl/d and 100 MMcf/d respectively. To take advantage of it, Petro-Hunt plans to begin an active development drilling program on these assets in the coming months heavily upgrading the numbers of its 775 operating oil wells and contributing to over 8,100 non-operated wells. Time will tell, however, whether or not this move will be able to deliver such results.

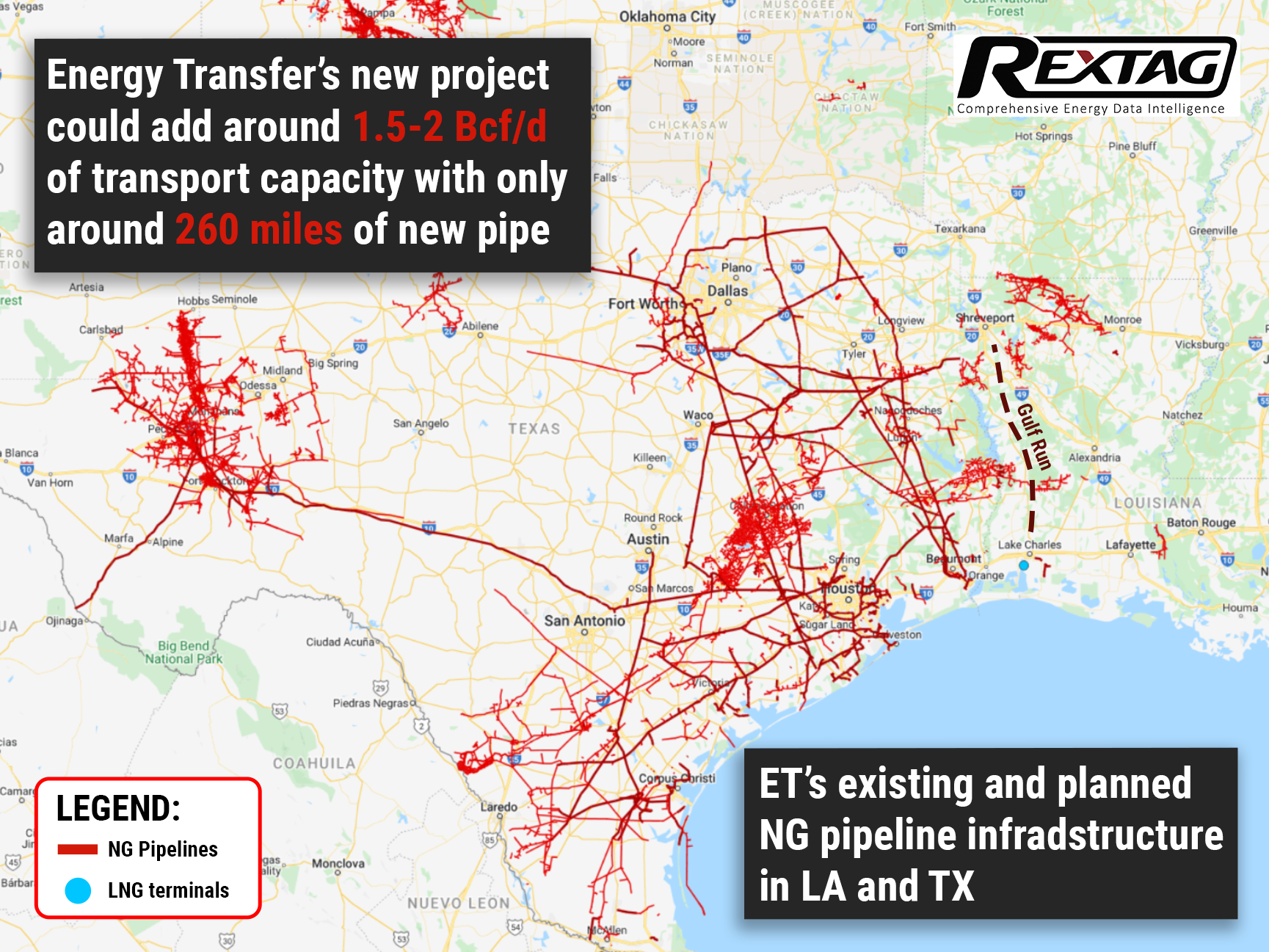

Energy Transfer LP Races to Carry Permian Basin Gas to Gulf Coast Hubs

The ever-increasing demand for natural gas exports from the Gulf Coast started a race to further develop Permian Basin. Various companies, including Kinder Morgan and MPLX, are among those looking at building new pipelines in the region due to the demand spike. But Energy Transfer seems to edge past them into the lead since its project strikes as the most economical option for the basin outside of capacity expansions on existing pipelines and could essentially add 1.5-2 Bcf/d of transport capacity with just 260 miles of new pipe.

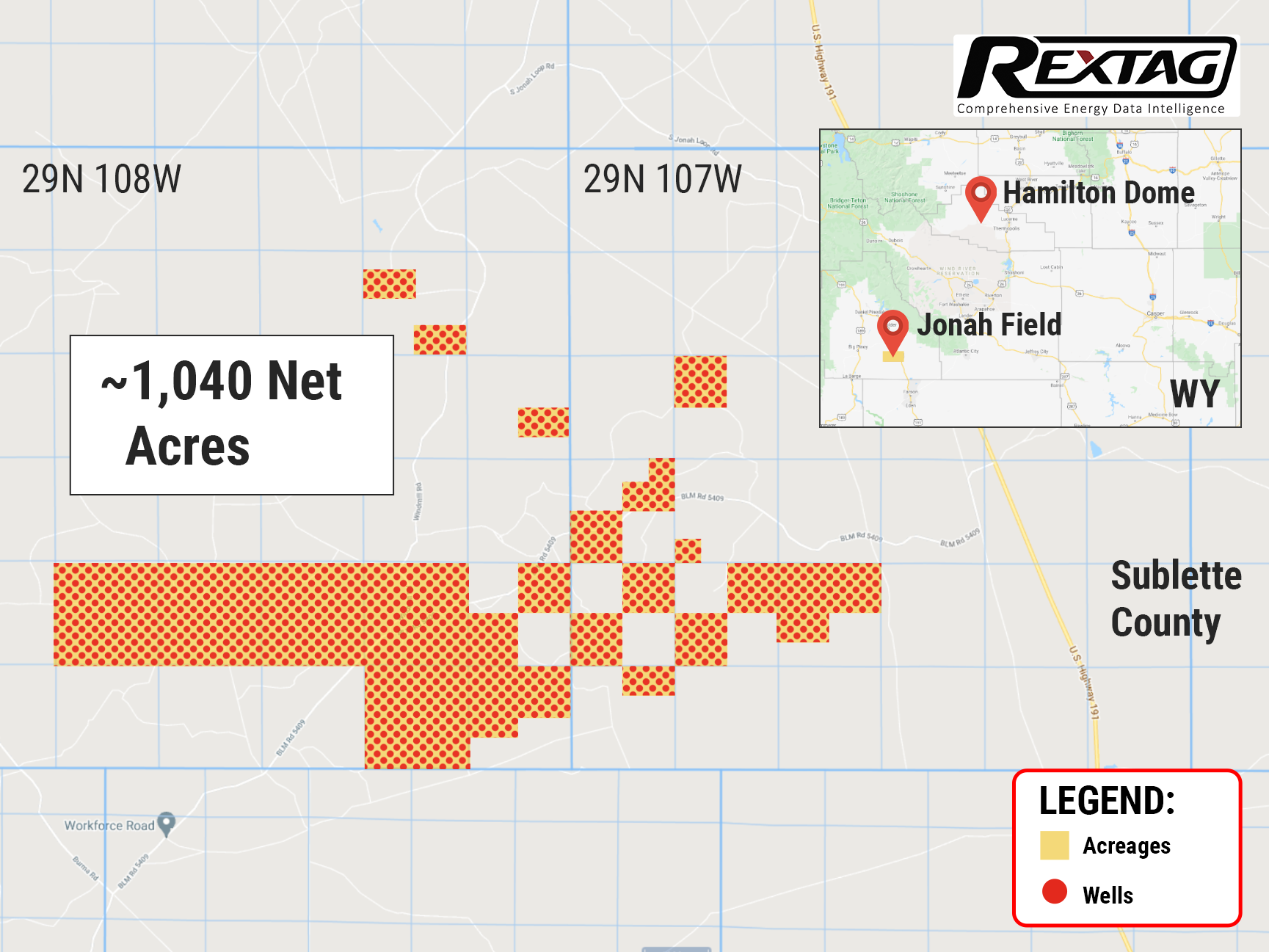

Evolution Acquires Non-operated Wyoming Natural Gas Interests

Evolution Petroleum just spend a fortune on Jonah’s Field right after acquiring Hamilton Dome Field in Wyoming. The price of the transaction is $29.4 million. The Houston-based company aims to diversify into natural gas assets, providing access to the western markets through the Opal market hub, with the optionality to flow to the east. That transaction took effect on February 1. We anticipate closing on or about April 1.

Continental Resources Raises Dividends Following a Quarter of Profit

The future of shale is looking bright: economic recovery and a spike in travel lifted oil prices to multi-year highs, helping Continental Resources to a fourth-quarter profit that exceeded Wall Street expectations. Coming off such a high note, the company plans to increase its dividend rates by 15% to 23 cents per share!

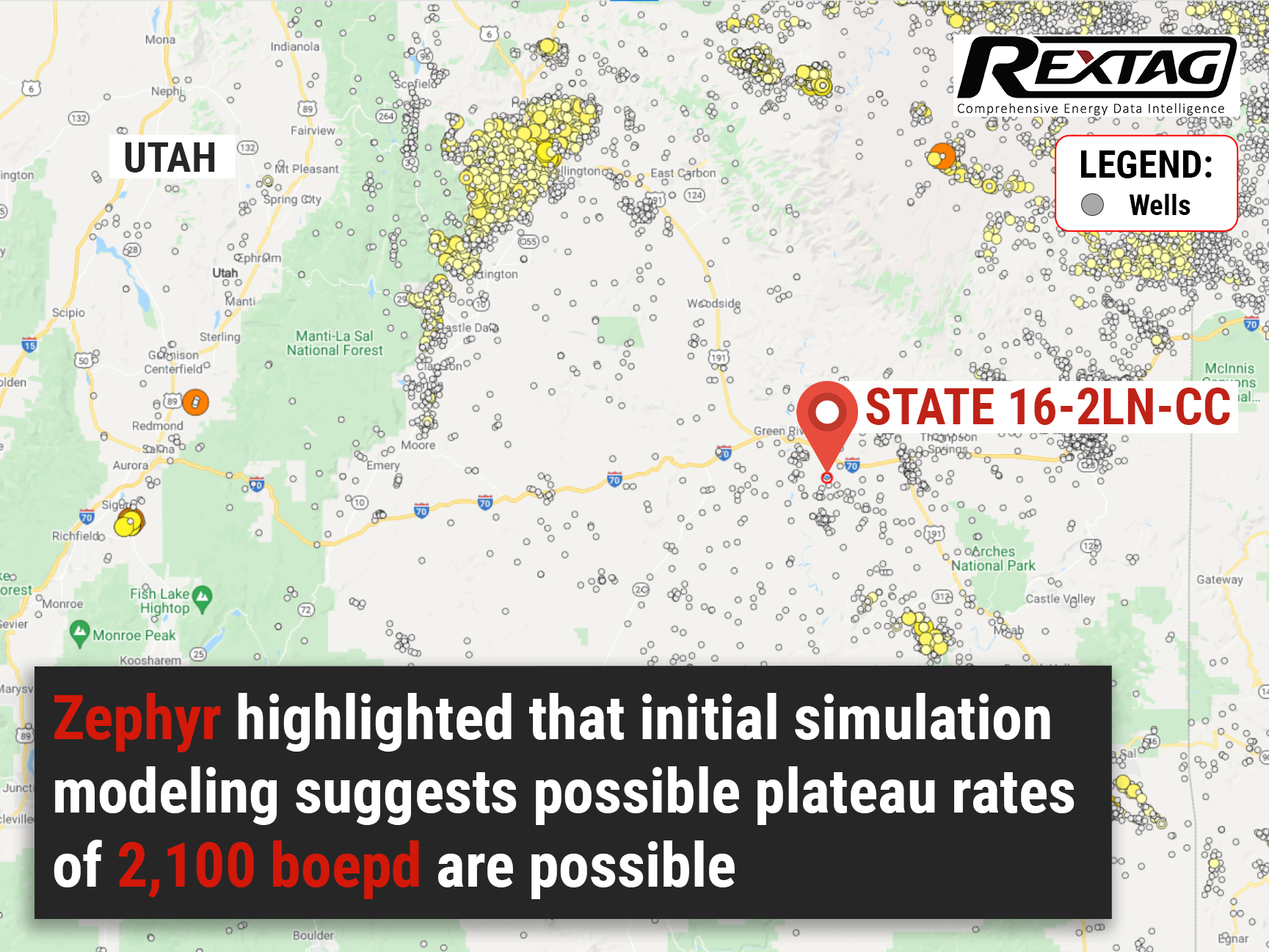

Northern Paradox Basins Rediscovered by Zephyr

After probing the initial discovery of eight high-grade hydrocarbon reservoirs, Zephyr Energy estimates that up to 200 wells could be drilled, creating a potential resource of 125 million barrels of oil equivalent in the area. In an investor presentation, Zephyr said that gas rates may reach plateaus of 10 million square cubic feet per day and 500 boepd of liquids. Quite an impressive number. But The key to tapping in such potential lies in the development of hydraulically stimulated resources rather than treating them as natural fracture plays.

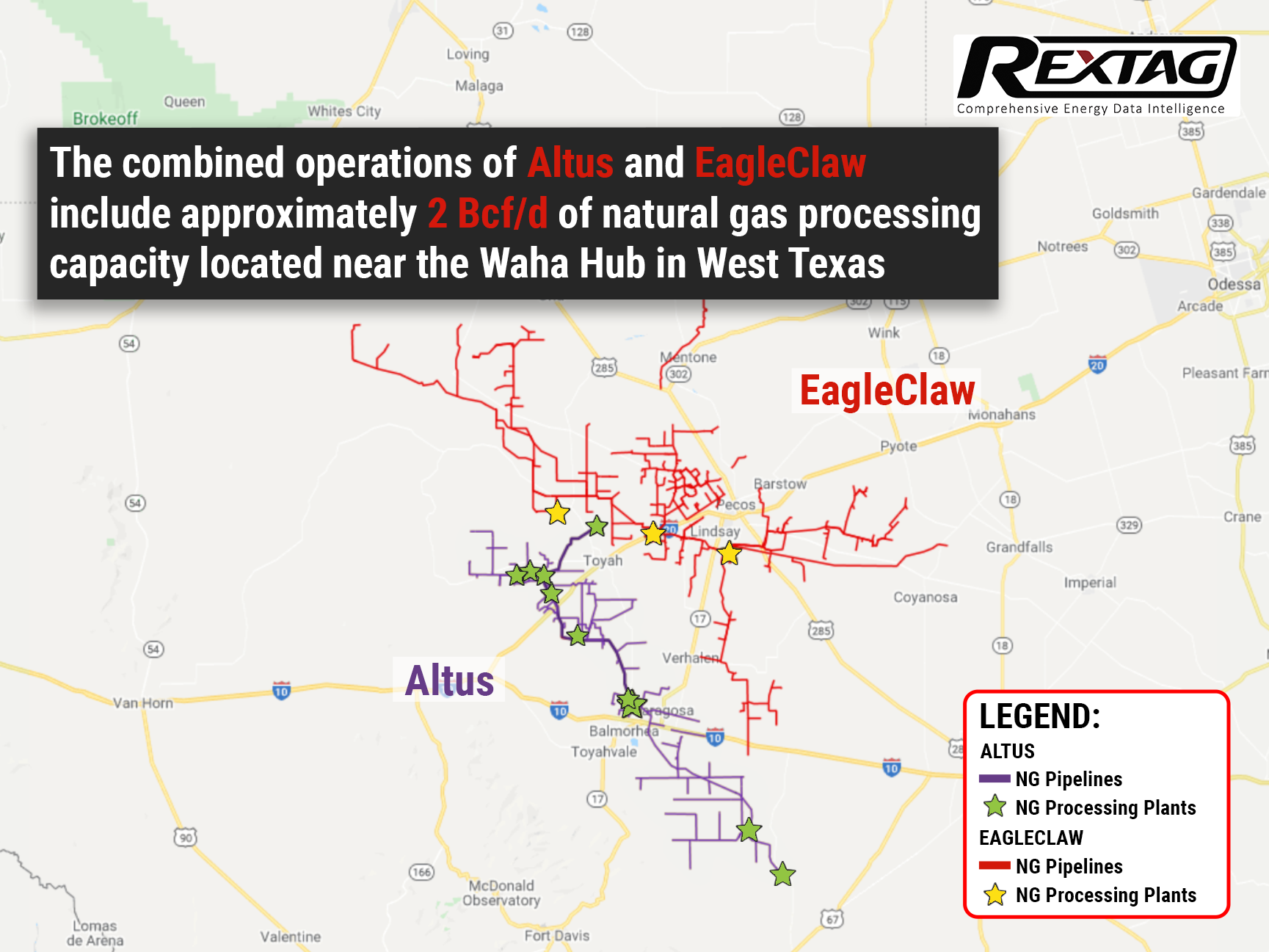

Apache's Altus Midstream to Merge with EagleClaw in All-stock Deal

Altus Midstream and EagleClaw Midstream agreed to combine operations in order to become the meanest midstream player in the Permian Basin! Following this merger, Altus will become the largest natural gas processor in the Delaware Basin, as well as the third-largest for the entire Permian Basin.

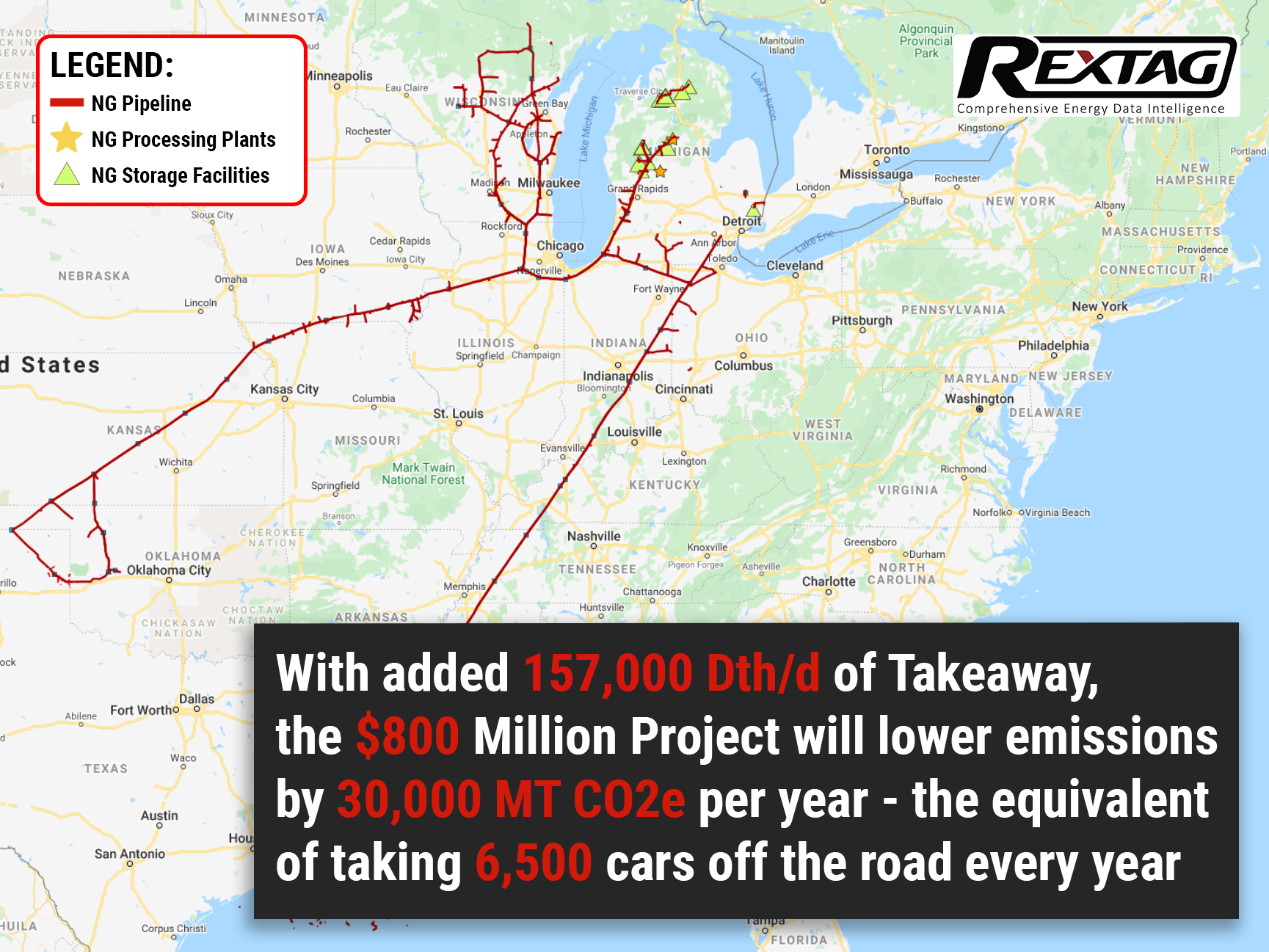

Expansion for TC Energy in Midwest US to cost $800 million

TC Energy splurged $0.8 billion on the project that targets emissions. Well, sorta. According to the idea, existing lines of the ANR Pipeline Company will be expanded to serve markets in the #Midwestern US and simultaneously updated to reduce discharge by 30,000 metric tons CO2e per year - equivalent to removing almost 7000 cars from the road annually. Remarkable goals. With the current timeline, the project will be fully operational by the end of 2025, thanks to long-term transportation agreements secured by ANR.

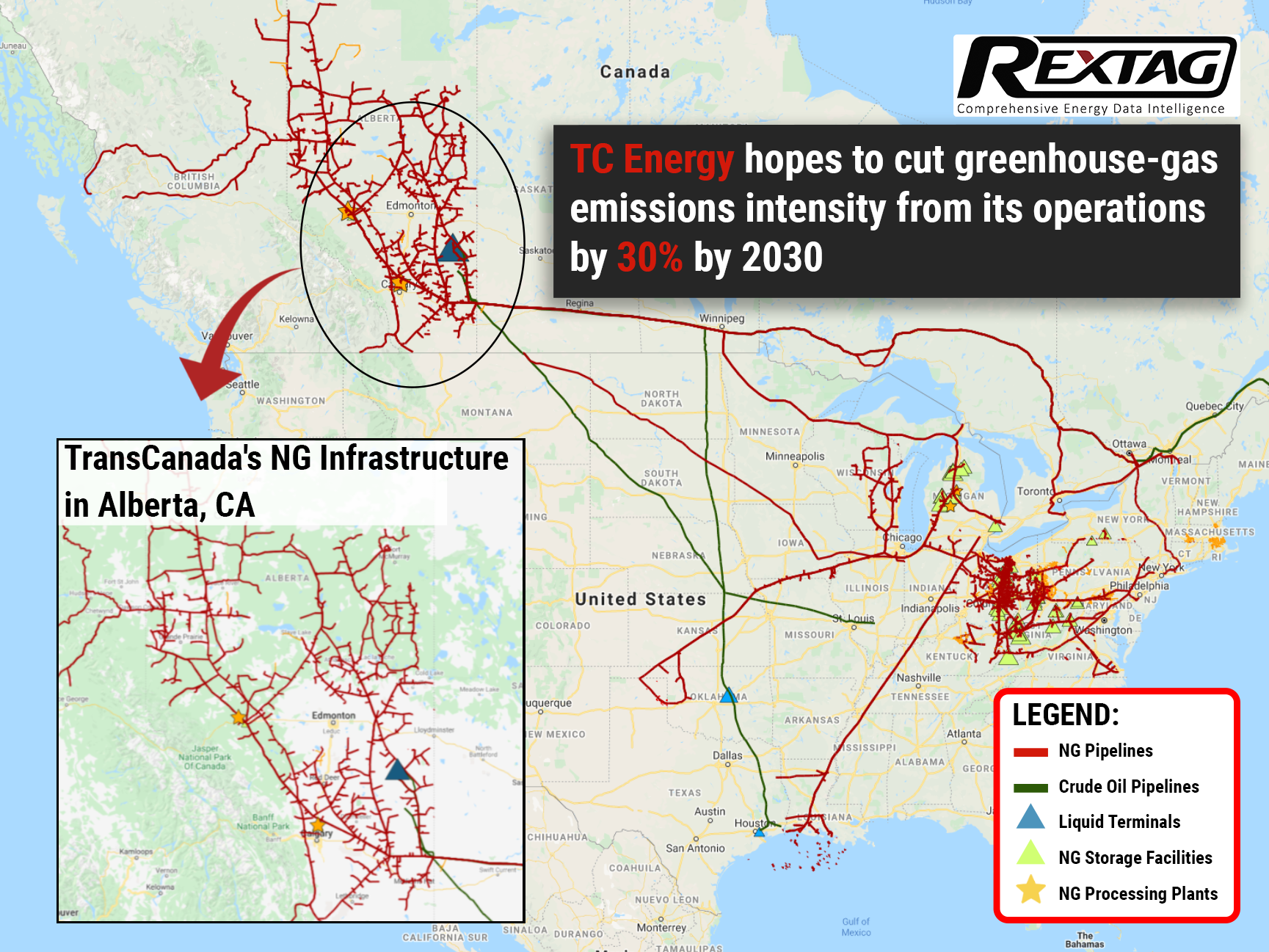

The green trend: TC Energy pledges to be carbon-free by 2050

TC Energy, the Canadian gas giant, recently announced its environmental, social, and governance goals, as well as emission reduction strategies. The company aims to become 100% emission-free by 2050 while promising to cut greenhouse gas emissions intensity from its operations by 30% by 2030 as an interim measure.

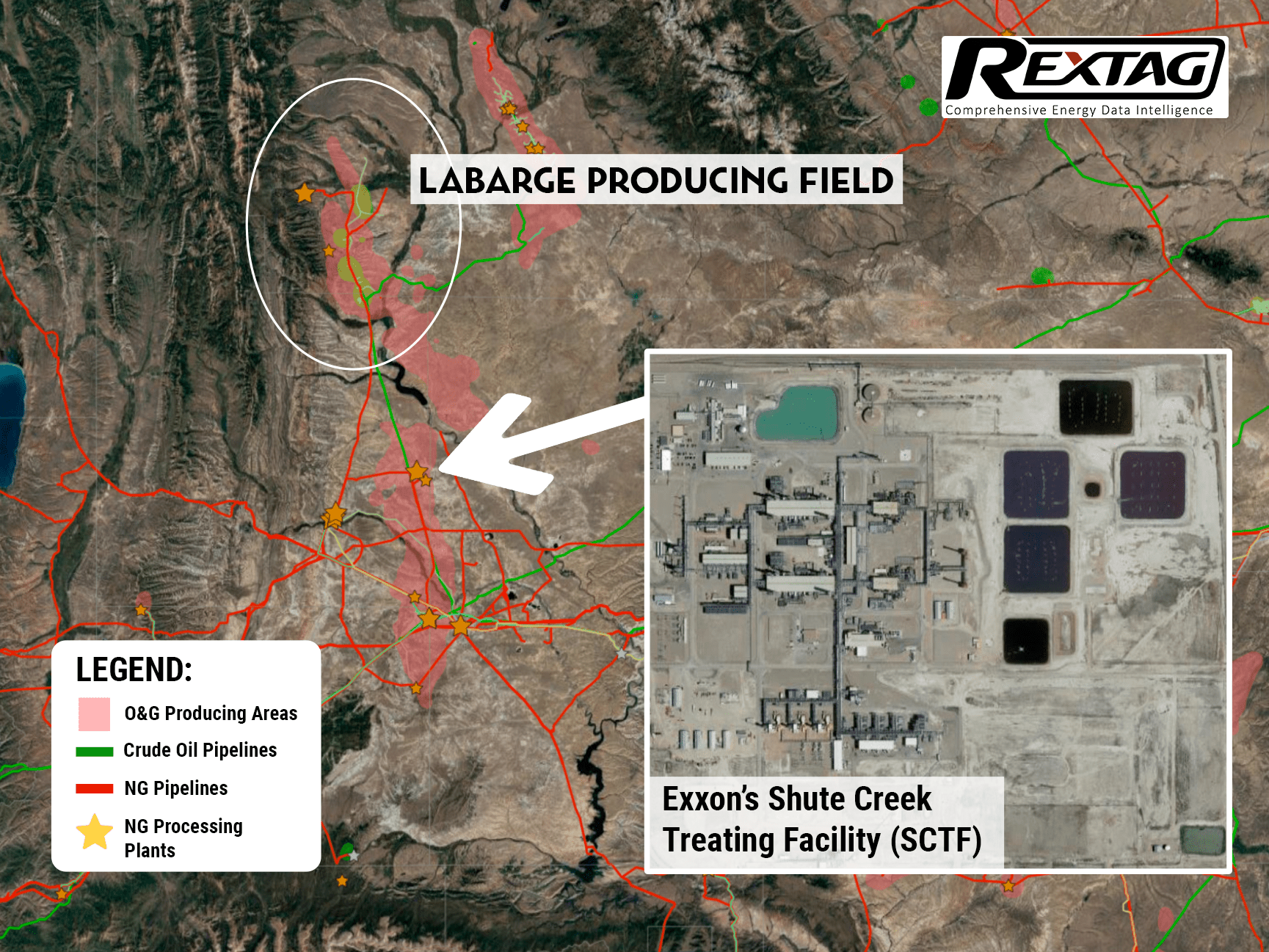

The Hunting Season Is Not Over Yet: Exxon Mobil makes a $400 million commitment to Wyoming's carbon capture

Carbon footprint reduction is a new hot trend: Exxon Mobil makes a $400 million investment into its LaBarge facility to expand its carbon capture and storage capabilities by another million metric tons of CO2. Operational activities could begin as early as 2025 after a final investment decision is made in 2022. At present, about 20% of all CO2 captured worldwide each year is captured at the LaBarge. However, as one of the largest of the world's Big Oil companies, it is not the only project in Exxon's pipeline: aside from CCS capabilities, the LaBarge is one of the world's largest sources of helium, producing approximately 20% of global supply

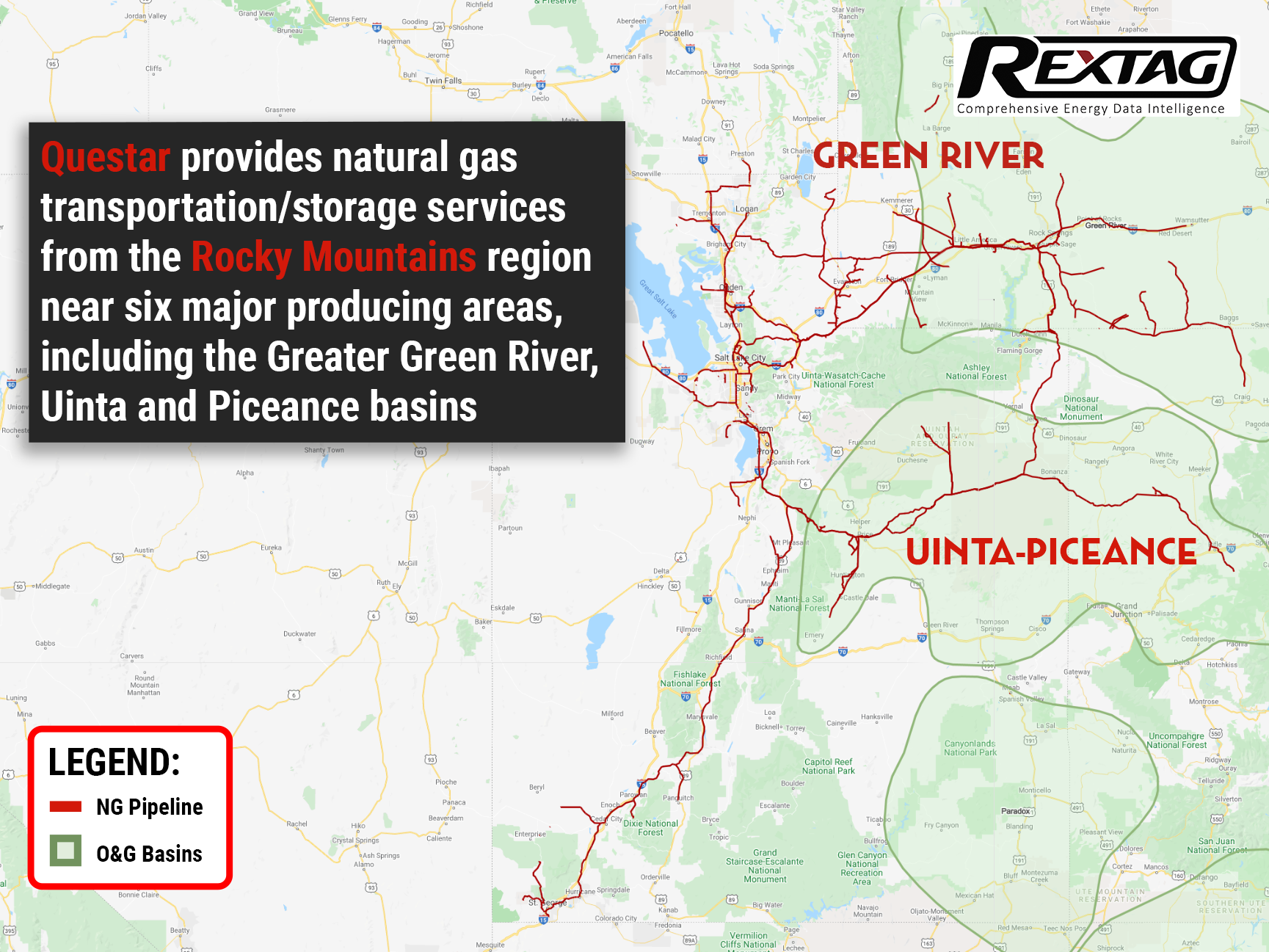

A $2 billion deal saw Dominion Energy sell Questar Pipelines to Southwest Gas

A good asset will not sit on the market for long. After a deal with Berkshire Hathaway fell through, Dominion Energy managed to secure another one for Questar Pipelines in a drop of a hat. And get that, it is better than the former one by more than half a billion! Although not everyone is happy with such decisions, it seems that even Carl Icahn’s complaints won't be able to sway Southwest Gas Holdings’ decision. Though we will have our eyes peeled in any case… If everything goes as planned, a $2 billion deal will be closed before the end of the year.

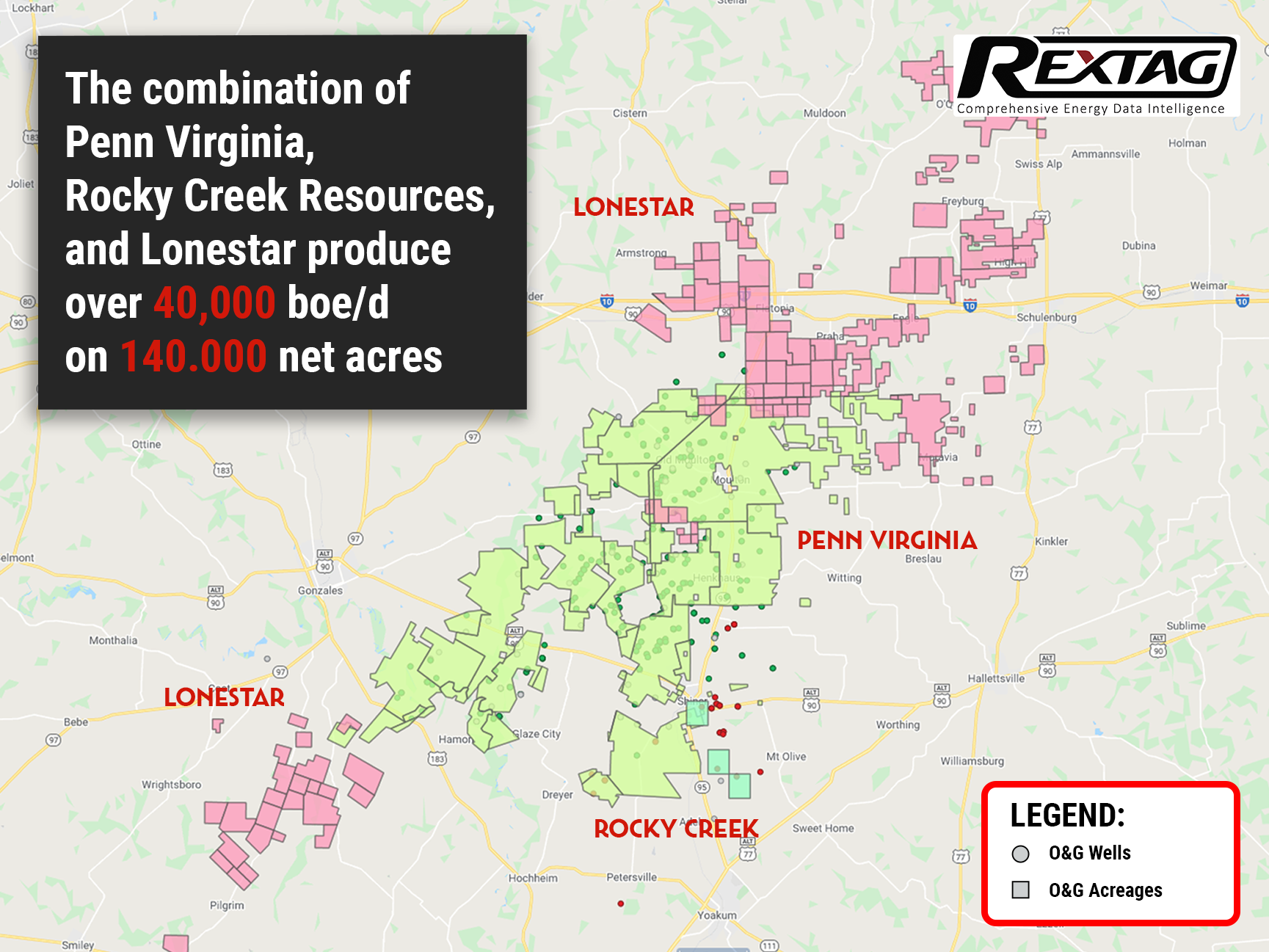

There is a new guy on the block: Penn Virginia rebrands to Ranger Oil

Penn Virginia announced a rebranding to Ranger Oil on 6 Oct. following the close of the Lonestar acquisition. This Texas oil & gas giant reinvents itself anew, shifting its energy development in the lone star state towards safer and more efficient oil and gas operations. The company's consolidated assets now amount to over 140,000 net acres strategically positioned in the Eagle Ford play of south Texas, making it one of the biggest players. It is anticipated that the full rebranding will be complete by the year-end of 2021. For the full rundown of the situation visit our blog.